Nvidia (NASDAQ: NVDA) shares dipped Friday after reports surfaced that the company has put the brakes on its H20 artificial intelligence chip designed for China. The news hit just as homegrown rival DeepSeek rolled out its newest AI model — one that runs smoothly on China’s own processors.

The timing highlights a growing challenge for Nvidia: Beijing is moving fast to cut its dependence on U.S. tech, and local players are starting to catch up.

On Thursday, DeepSeek — one of China’s most closely watched AI startups — unveiled its upgraded V3.1 model. The system brings faster processing speeds, a new FP8 precision format, and a hybrid inference setup that can switch between reasoning and non-reasoning tasks. It even comes with a “deep thinking” feature and new API pricing set to launch on September 6.

The company had previously leaned heavily on Nvidia’s chips after running into performance issues with Huawei’s Ascend processors. But DeepSeek’s breakout R1 model, released in January, shook global markets, wiping about $600 billion off Nvidia’s market value amid fears that a true competitor had finally arrived.

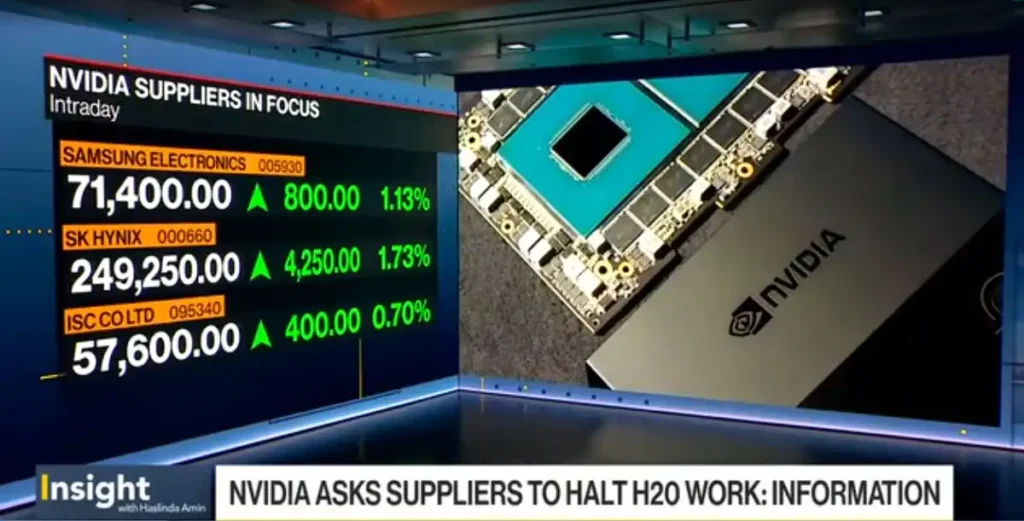

Meanwhile, Nvidia is facing intensifying regulatory pressure in China. According to reports, the chip giant has told suppliers — including Amkor Technology (NASDAQ: AMKR) and Samsung Electronics (OTC: SSNLF) — to pause work on the H20 chip. The move follows high-level meetings between Chinese officials and tech giants like Tencent (OTC: TCEHY) and ByteDance, where regulators urged companies to pivot toward domestic alternatives from Huawei and Cambricon.

Analysts warn that the fallout could be costly. KeyBanc Capital Markets estimates that cutting out China could slash Nvidia’s quarterly revenue by $2 to $3 billion. Still, Nvidia’s next-gen Blackwell B200 chips and red-hot global demand may soften the blow. China made up 13% of Nvidia’s revenue in fiscal 2024, underlining just how vital the market remains.

Despite the headwinds, Nvidia has still gained more than 30% this year, holding its crown as the dominant force in graphics processors while Big Tech players like Microsoft (NASDAQ: MSFT) and Meta (NASDAQ: META) pour billions into AI.

As of Friday morning, Nvidia stock was down 1.14% in premarket trading, sitting at $172.98.