Of the 47 ADA lawsuits filed by attorneys Jessica Molligan and David Foster, nearly half involved Asian-owned businesses, according to public records and interviews.

PORTLAND, Ore. — Several Asian-owned businesses feel they have been targeted by a pair of Portland attorneys who have filed dozens of lawsuits under the Americans with Disabilities Act (ADA) over the past nine months.

“We’re an easy target,” Sara Tran said. One of the attorneys sued her mother, Hanh Tran, for alleged ADA compliance issues.

“We don’t know the law,” Hanh said. “We don’t speak the language well and we don’t know how to get help.”

Hanh immigrated from Vietnam when she was 19. The Portland woman worked three jobs, seven days a week, to support her three children. About seven years ago, she saved up and invested in a small shopping center.

“It’s a dream to own the building,” Hanh said.

The nondescript building on Southeast Clackamas Road in Clackamas houses a hair salon, a nail salon, a Thai restaurant and a tattoo parlor.

The building didn’t seem to have anything wrong — until Hanh received a demand letter from a Portland attorney claiming the property violated the ADA. The initial letter didn’t specify what needed to be fixed, but it did propose a settlement agreement. The attorney wouldn’t sue if Hahn agreed to make repairs, bring the property into compliance and pay the attorney’s fees. But he had to act fast.

“We need to fix it within two weeks,” Hanh explained.

Hanh hired a contractor to repaint the parking lot lines and installed the van-accessible parking signs within six days. Despite the improvements, attorney Jessica Molligan filed a lawsuit, leaving Hahn scared and confused.

“We don’t know the law, so it’s like it’s the whole family. We’re worried,” Hanh said.

In May, a KGW investigation found that Molligan and another Portland attorney, David Foster, had sued more than three dozen Portland-area businesses since September. The convenience stores, restaurants and gas stations are accused of violating some technical aspects of the ADA.

In many cases, homeowners said they were willing to make the repairs but did not like the lawyers’ tactics: They threatened litigation and demanded fees, which typically ran about $10,000 per case.

“It looks like extortion,” said building owner Mike Davis.

The ADA is the 1990 federal law that protects the rights of people with disabilities. Title III of the ADA requires that all businesses open to the public be accessible—that is, that they provide people with disabilities with equal opportunities to access the goods or services they offer. If businesses fail to comply, they can be sued without warning. The federal government does not have an office to oversee or enforce the ADA; instead, people with disabilities, their attorneys, and judges help enforce the ADA.

New construction must be done in accordance with ADA standards. Buildings built before 1991 must remove existing barriers where possible.

Since KGW published its original report, at least a dozen other business owners have reached out to us to report receiving nearly identical demand letters or lawsuits. Most were Asian-owned businesses.

“We believe they’re coming after our businesses and they’re targeting minority communities, specifically Asians, because a lot of the business and property owners are first generation. Language is a barrier and they tend to not resist and conform,” said David Kim.

Of the 47 ADA lawsuits filed by attorneys Jessica Molligan and David Foster, 22 of them (nearly half) involved Asian-owned businesses, according to court records, state filings and interviews.

“The statistics don’t lie. They’re just blown out of proportion,” said the building’s owner, Rich Baek.

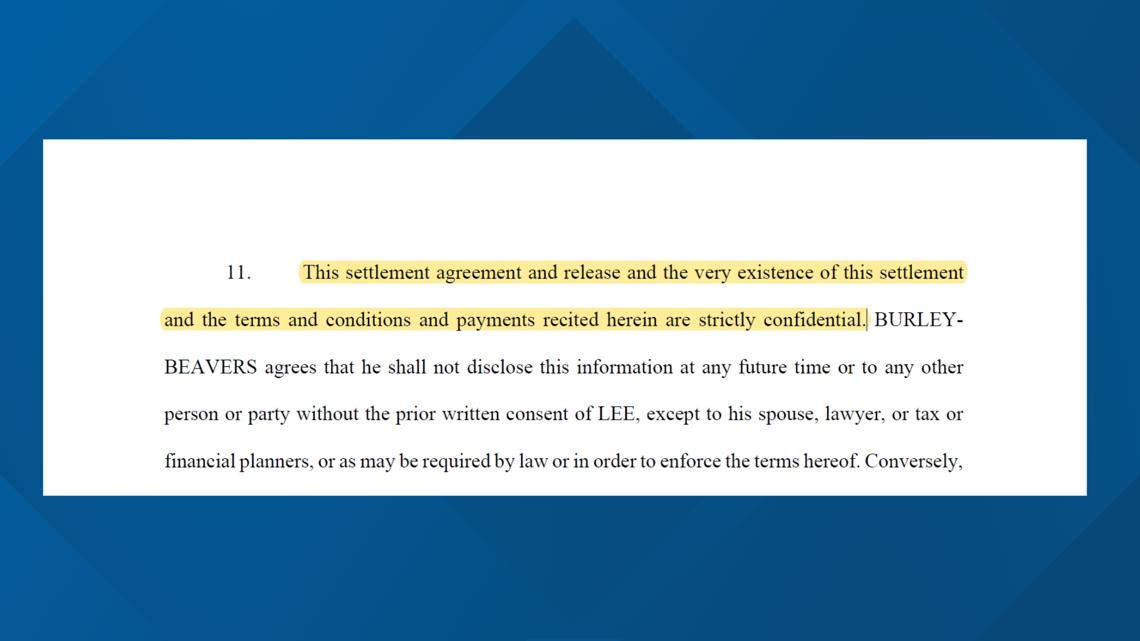

Those are the cases revealed in the records, but there may be others. Many small businesses said they had been ordered to keep things secret, and court records back up that claim.

A settlement agreement with Jessica Molligan states that details about terms, conditions and payments will be kept “strictly confidential.” The secret documentation only became public after Molligan sued an Asian-owned company that failed to pay her $6,000 in attorney fees.

“The lawyers look pretty bad and I think it makes us look even worse, unfortunately,” said consumer advocate Michael Fuller. The Portland attorney agreed to help Hahn for free. The case was eventually dismissed, but not everyone has the same legal muscle to fight back, especially small, Asian-owned businesses.

“I’m very sad about this because my mother is a very hard-working person and other people in the community are also hard-working people. And we are migrants. We are the backbone of the community,” said Sara Tran.

Responding to KGW’s emails, attorney Jessica Molligan wrote: “Asian businesses are not being targeted. That is beyond offensive.”

The other attorney, David Foster, retired from ADA cases and has since been replaced by Molligan.

“I am no longer acting as an attorney,” Foster wrote in an email to KGW. Foster went on to explain that he had been hired as a local attorney by an out-of-state firm, Wampler, Carroll, Wilson and Sanderson of Memphis, Tennessee.

So why would a Tennessee law firm want to file ADA cases in Oregon? The law firm did not respond to KGW’s inquiries by email or phone.

It’s unclear whether Asian-owned businesses are being targeted or if it’s just a coincidence. But in any case, court records suggest that a segment of the community is being disproportionately affected by threatening letters and lawsuits — and then, in many cases, told to keep quiet about it.

Are you a business or property owner in Oregon and have received a demand letter or lawsuit related to ADA violations? If so, we would like to hear from you. Please fill out this form.