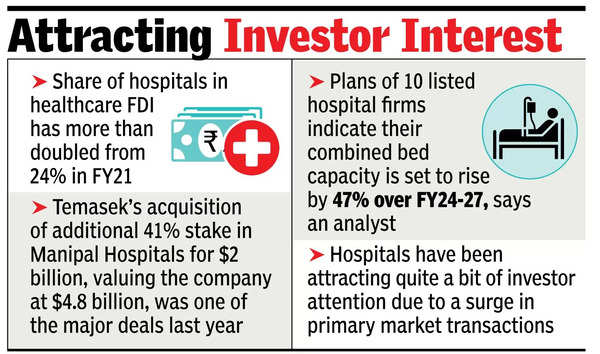

NEW DELHI: Deal-making in India’s healthcare sector has surged in recent years, with hospitals now commanding the largest share of foreign direct investment (FDI) within the sector. In FY24, hospitals accounted for 50% of the FDI in total healthcare, translating to $1.5 billion. This marks a significant increase, as the share of hospitals in healthcare FDI has more than doubled from 24% in FY21, and has been rising from 43% in FY20, underscoring their growing prominence.

The trend also reflects a strengthening investor preference for hospitals, alongside the traditionally favoured pharmaceuticals sector.

Historically, the pharmaceuticals sector, including APIs (active pharmaceutical ingredients), has been the investor favourite, attracting multi-billion-dollar deals. However, post-Covid, the hospital and diagnostics sector has come into the spotlight, drawing a wave of investors and culminating in top-dollar buyouts of major chains such as Manipal and Max. Last week, Aster DM Healthcare announced its decision to merge with Quality Care India.

“Hospitals have been at the centre of PE interest over the last few months. The size of the Indian market, relatively underserved markets outside the urban areas, high incidence of disease burden and growth in insurance (both public and private), will continue to fuel growth. Given the demand, there is still a long road for growth. Hence the optimism,” Sujay Shetty, global health industries advisory leader, PwC India said.

One of the major deals last year was Temasek’s acquisition of an additional 41% stake in Manipal Hospitals for $2 billion, valuing the company at $4.8 billion.

“The country needs investment in quality healthcare and healthcare facilities to reach its goal of a $5 trillion economy. The hospital sector is capital intensive and not really a dividend-paying sector. The sector is reinvesting its profits to create infrastructure, which is demonstrated by the largest capital investment cycle undertaken in the history of our sector, the promise of which is showing up in valuations. At Max alone, we are in the midst of doubling our capacity over the next three years at a cost of over Rs 5,000 crore,” Abhay Soi, CMD, Max Healthcare stated.

Further, hospitals have garnered significant investor attention due to a surge in primary market transactions. With six hospitals completing their IPOs, interest from new investors – primarily private equity seeking ownership – has increased, analysts told TOI.

Over FY24-27, plans of the 10 listed Indian hospital firms indicate that their combined bed capacity is set to rise by 47%, with most of the expansion planned in north and south India, Tausif Shaikh, a BNP Paribas analyst said in a recent note.

During the four-year period, the listing of seven new large hospital chains on the bourses bolstered the growth, collectively raising around Rs 3,600 crore as primary funding during IPO/QIPS (qualified institutional placements), analysts told TOI.

Leave a Comment